All about Paul B Insurance Part D

Table of ContentsThe Greatest Guide To Paul B Insurance Part DNot known Facts About Paul B Insurance Part DPaul B Insurance Part D Fundamentals ExplainedUnknown Facts About Paul B Insurance Part DPaul B Insurance Part D Things To Know Before You Buy

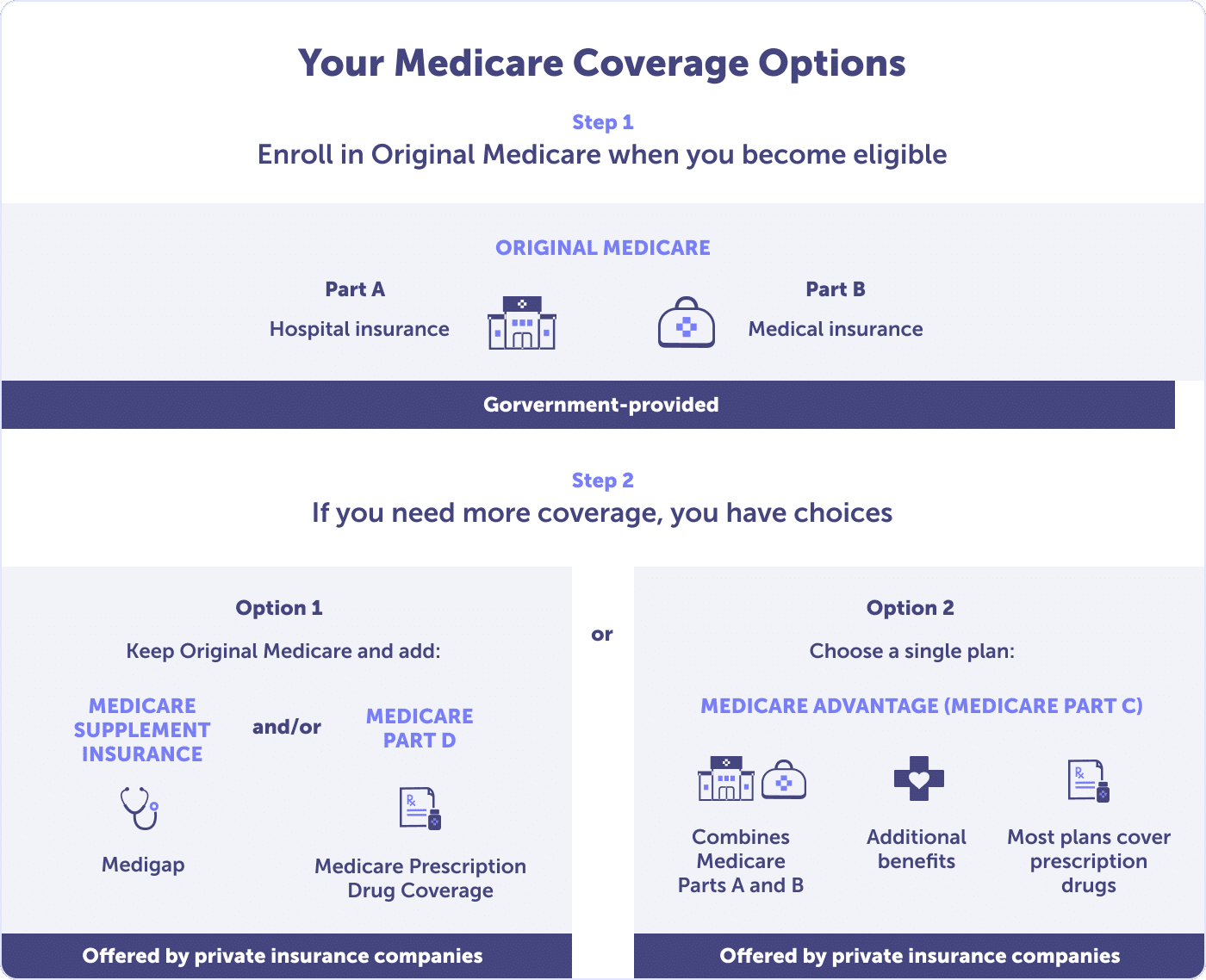

In Original Medicare: You go directly to the doctor or medical facility when you need care. It is very important to comprehend your Medicare coverage options and to choose your protection carefully. How you pick to get your advantages and who you get them from can affect your out-of-pocket expenses and where you can get your care. For example, in Original Medicare, you are covered to go to nearly all doctors and hospitals in the country. However, Medicare Benefit Plans can likewise supply fringe benefits that Original Medicare does not cover, such as routine vision or oral care. What is Medicare Advantage? What are the advantages and constraints of Medicare Benefit plans? Exist any defenses if I register in a strategy and do not like it? Are any Medicare Managed Care Plans available where I live? Medicare Benefit broadens health care alternatives for Medicare beneficiaries. These options were produced with the Balanced Budget Act of 1997 to decrease the growth in Medicare spending, make the Medicare trust fund last longer, and provide beneficiaries more choices. It is very important to keep in mind that each of these options will have benefits and limitations, and no option will be best for everybody. Not all options will be readily available in all locations. Please Keep in mind: If you do not actively pick and register in a new strategy, you will remain in Original Medicare or the initial Medicare managed care plan you currently have. You should not alter to a brand-new program till you have actually carefully analyzed it and determined how you would gain from it. Original Medicare will constantly be readily available. If you wish to continue receiving your benefits in this manner, then you do not have to do anything. This is a managed care strategy with a network of providers who contract with an insurance provider. You concur to follow the guidelines of the HMO and utilize the HMO's service providers.This is comparable to the Medicare Benefit HMO, except you can utilize companies outside of the network. The companies administer the plan and take the financial danger. The strategy, not Medicare, sets the charge schedule for companies, however service providers can bill up to 15%more.

Little Known Facts About Paul B Insurance Part D.

You see any companies you pick, as long as the provider consents to accept the payment schedule. Medical requirement is identified by the plan. paul b insurance part d. This is one of the handled care plan types(HMO, HMO w/pos, PPO, PSO) which is formed by a spiritual or fraternal company. paul b insurance part d.

)pays Learn More the plan a strategy amount for each month that a beneficiary is recipient. You have Medicare Part A and Part B.You pay the Medicare Part B premium.

Paul B Insurance Part D Can Be Fun For Everyone

Medicare Advantage plans need to offer all Medicare covered services and are authorized by Medicare. Medicare Advantage strategies might supply some services that Medicare does not typically cover, such as regular physicals and foot care, dental care, eye exams, prescriptions, hearing help, and other preventive services. You would have to find another Medicare Benefit strategy or get a Medicare Supplement Policy to go with your Initial Medicare.

A recipient would be eligible for the Medicare Supplement protections if they meet one of the following criteria. The strategy service location no longer covers the county where you live. You vacate the strategy service area. There are offenses by the plan. Protection: In this case, you would get a guaranteed concern of a Medicare Supplement Plan A, B, C, or F from any company (as long as you apply within 63 days of losing your other protection). Then you disenroll from the strategy within 12 months and return to Original Medicare. Security: You are able to return to the very same Medicare Supplement plan with the same company if it is still available. If it is not still offered, you will get a Medicare Supplement plan A, B, C, or F from any see page company (as long as you apply within 63 days from disenrolling). You select a primary care provider within.

The 6-Minute Rule for Paul B Insurance Part D

the HMO network. When you stay within the network, you pay nothing except the strategy premium and any little copayment quantities pre-programmed by the HMO.You may also pick to use services beyond the network. When you choose to utilize a service or service provider outside the Expense Agreement HMO network, Medicare would still pay their usual share of

the authorized amount. The Cost Agreement HMO would not pay these. Expense Contract HMOs may register you if you do not have Medicare Part A but have and pay for Medicare Part B. Expense Agreement HMOs do not need to enroll you if you have end-stage kidney illness or are already registered in the Medicare hospice program. If you enlist in a private fee-for-service, you can get care from any Medicare doctor that accepts the strategy's terms, however you need to live in the plan's service area to be qualified. Medicare pays the strategy a set quantity monthly for each recipient enrolled in the strategy. The strategy pays service providers on a fee-for-service basis.